In making business transactions, we all need an invoice to claim the VAT we paid for. A VAT invoice includes all the details of the purchases made and the services provided. VAT is a very useful component for the companies as the taxes can be recovered from such companies. Businesses exceeding a certain limit of revenue have to register for VAT. Not doing so can result in non-compliance to the government.

Businesses voluntarily register for VAT even when they do not have to. It will get them a benefit of not crossing the threshold at any time and avoid any penalties and fines. Starting a new business can be challenging but businesses who register for VAT get an edge from ordinary small businesses. But registering for VAT can help the business get external finances from venture capitalists as well as banks.

Not only is getting finance easier for VAT registered companies but some vendors and customers also do not like doing business with companies that are not VAT registered. So by registering for VAT, the business will hold a specific VAT number which makes it easy to do business with third parties.

VAT is also very helpful when making purchases globally. The amount spent can be recovered using the VAT number. Tax-free purchases or the purchases on which tax can be recovered always bring a lot of comfort for the buyers.

VAT stands for Value Added Tax and the invoice mentions the details about how much tax is to be applied for a particular item or the service rendered.

Create professional invoices with our free Excel invoicing templates and spreadsheet samples, as easy as filling a blank paper form! Each template comes with an editable Excel spreadsheet / workbook template and a PDF invoice generated with the template. Browse the categories to find templates designed for sales companies, service.

Invoice with tax calculation. Set the tax rate and calculate the tax automatically on the sale of your products or services with this basic, accessible invoice template for Excel. This invoice with tax calculation template is ideal for small to medium-sized businesses. In a hotel management, the good flow of cash means that the establishment is doing well. A well-made invoice in the form of Microsoft Word or Excel will make all the payments be given accurately by the customer while they are at the hotel, at General Invoice Template you can look the right form of receipt for your hotel that will suit every check in and reservations of all your customers as. The invoice should also have businesses’ name and logo on top and a few details along with. This invoice can also be used for any repairing purposes. If the product needed some repairs, the details must be mentioned on the invoice including any labor costs etc. Jewelry Invoice Template. For: EXCEL(.xls) 2003 & later Android+iOS & iPad.

The VAT invoice is a document that notifies an obligation to make a payment. A registrant or registered taxpayer means a taxable person who is registered for VAT and is required to charge VAT and file VAT returns on time. A few requirements are to be fulfilled for making a good and considerable VAT invoice. The requirements are mentioned below.

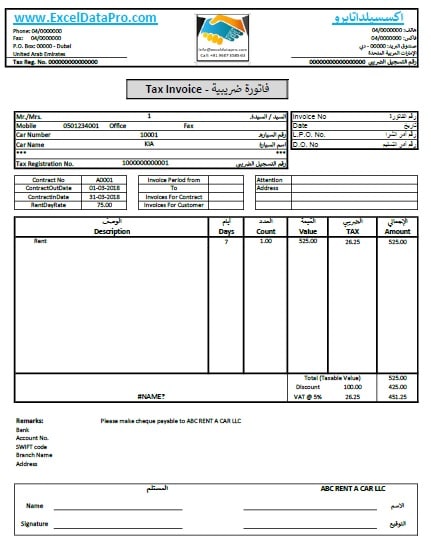

The invoice must open with the name and logo of the company along with the contact details like address, contact number, and VAT number that the company has. The numeric-like date on which the invoice is issued and the invoice number must be correctly placed where it can be seen properly.

Name of the person company interested in VAT invoice must be written on the top under the company details, in block letters for better illegibility. The name must be followed by contact details like address, phone number, city and ZIP code, etc.

A few columns must be drawn out to give a detailed view of what product or service the VAT is applied on, along with the product ID. Another column must be specified to apply the VAT rate and the VAT amount must be mentioned separately for each item. Then, in the end, the amount totaled to be paid must be written properly where it can be seen and read without any confusion.

A VAT invoice includes:

- Company name

- Contact details of the company

- Customer details

- Description of the purchase/services

- Unit price and quantity of a purchased item

- VAT rate applicable

- VAT registration number

- Terms & conditions of payment

- Mode of payment

Preview

VAT Invoice Template

For: EXCEL(.xls) 2003 & later [Android+iOS] & iPad

DownloadFile Size: 40 kb

For: OpenOffice Calc [.ods] | Download File Size: 19 kb

[Personal Use Only]

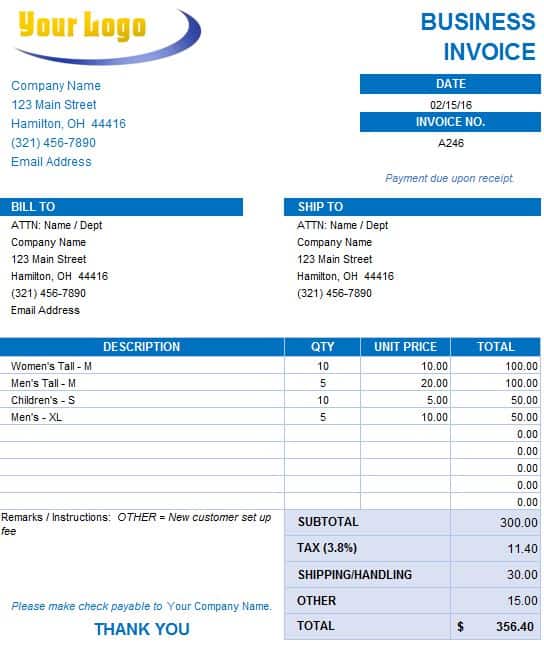

Toda’s topic: “Tax Invoice Format“. Looking for an excel invoice format for the revolving of cash flows and counseling the circle of finances at the government sector, the government imposes various kinds of taxes to generate revenue. Therefore there are properly calculated tax invoices. These invoices are generated and issues to keep an accurate track of the amount deductions and their corresponding details.

Tax Invoice Format in Excel

For all different kinds and purposes of taxes, there are different kinds of formats and their procedural derivation including the basis of their calculations.

Tax invoices are usually issues from different organizations, banks and government departments over the deduction of due taxes on your activities.

Such as vehicle invoices are issued from excise departments, sales tax and income tax are issued from boards of revenues and similarly, savings tax and banking taxes are deducted from banks.

Now in order to maintain a standard understandable draft, there are devised invoice formats Dmi tool version nbdmifit 2 14 download. implemented all over the country. No matter what region you belong you, the same invoice with a taxpayer number is issued over the deductions of the amount.

Invoice Tax Category

Usually, taxes are imposed over the specific ration of a devised amount to be held for any activity. These taxes are collected by the corresponding departments yet are deposited at a central collection center which places all the tax revenues. So commonly the tax invoice formats are different for different categories of taxes.

For transport taxes, invoices are usually headed with the tax collection department, followed by the categories of various vehicles, their corresponding percentage of taxes and the specimen calculation of tax with all supporting details.

Similarly, for property tax, there are different categories of houses and their area wise tax imposition calculator is mentioned in the invoice. These categories are further aided with the decimal tax proportions and a fixed taxpayer number which is specified to each person.

Format for Excel Spreadsheet

Excel spreadsheet is one marvelous tool for the rapid calculation and formulations based quick drafting of all kinds of invoices and financial documents. There are hundreds of formats of tax invoices available for Microsoft excel. Usually, there are the following steps being taken while drafting an invoice in Excel.

Header with the department’s name and detail of tax category in the below region

Categories of products or items are mentioned

Their relevant tax proportions are mentioned on alternate axis

The calculation is mentioned according to the requirement

Some of these amounts are mentioned in the end

Download Tax Invoice Templates

Template 1:

Filename: “tax-invoice-template”

File Size: 153 Kb

File Format: Ms Excel(xlsx)

Template Type: Basic (Free)

Download File: Comment Below to get free template *Mention Valid Email

Author Name: John Mathew

Template 2:

Filename: “tax-invoice”

File Size: 106 Kb

File Format: Ms Excel(xlsx)

Template Type: Basic (Free)

Download File: Comment Below to get free template *Mention Valid Email

Author Name: John Mathew

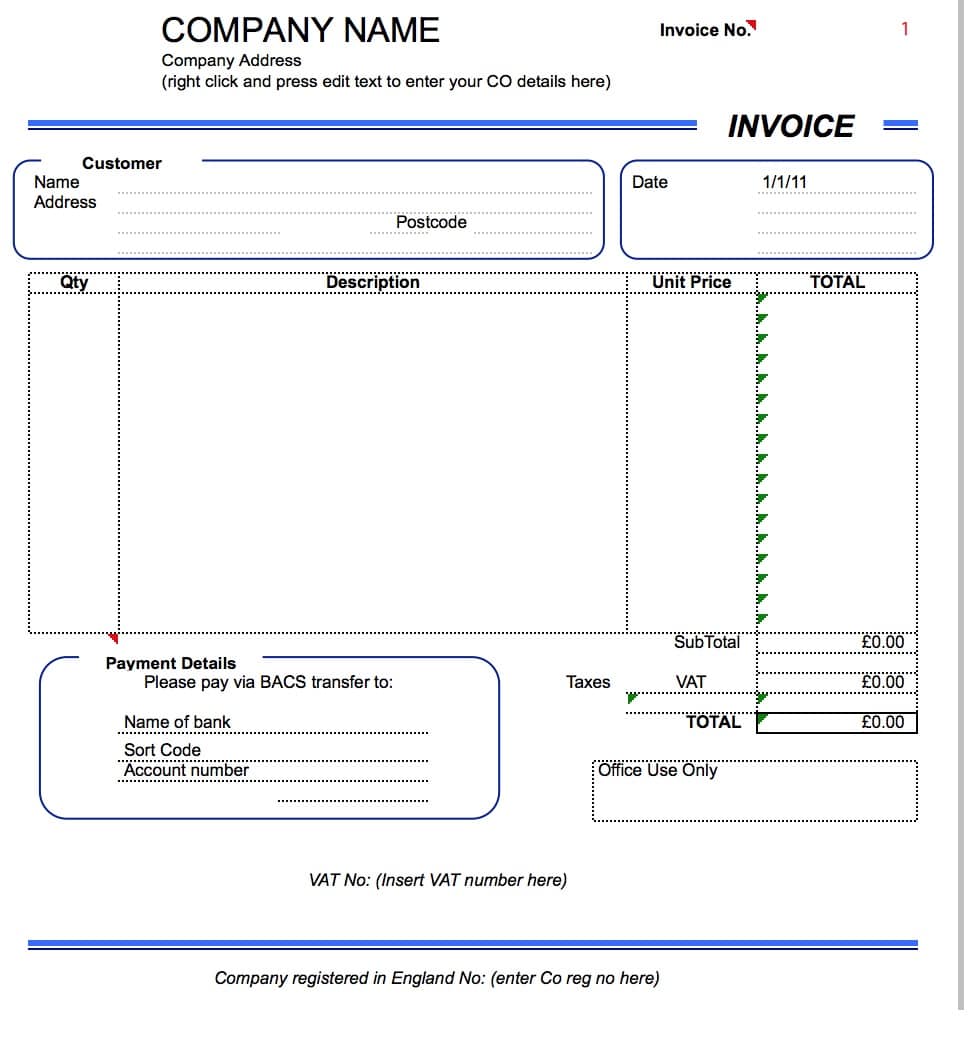

Template 3:

Filename: “tax-invoice-format”

File Size: 106 Kb

File Format: Ms Excel(xlsx)

Template Type: Basic (Free)

Download File: Comment Below to get free template *Mention Valid Email

Author Name: John Mathew

Vat Invoice Format In Excel Sheet

Format Varies Yet Enhances the Job

While writing financial documents, removing all kinds of minimal and maximum human errors and technical calculative errors should be removed in order to avoid any kind of financial disposition in the matters.

Vat Invoice Format In Excel Spreadsheet

This job is made easier with the help of computer software applications and various tools which precisely stern out the exact amount which is relevant to the purpose. Tax invoice formats for excel vary according to the category yet they enhanced the job.